It's Not You, It's the System: The Hidden Engine of the Cost-of-Living Crisis

The Cost of Living Crisis and its Systemic Origins

The Real Reason You're Getting Poorer

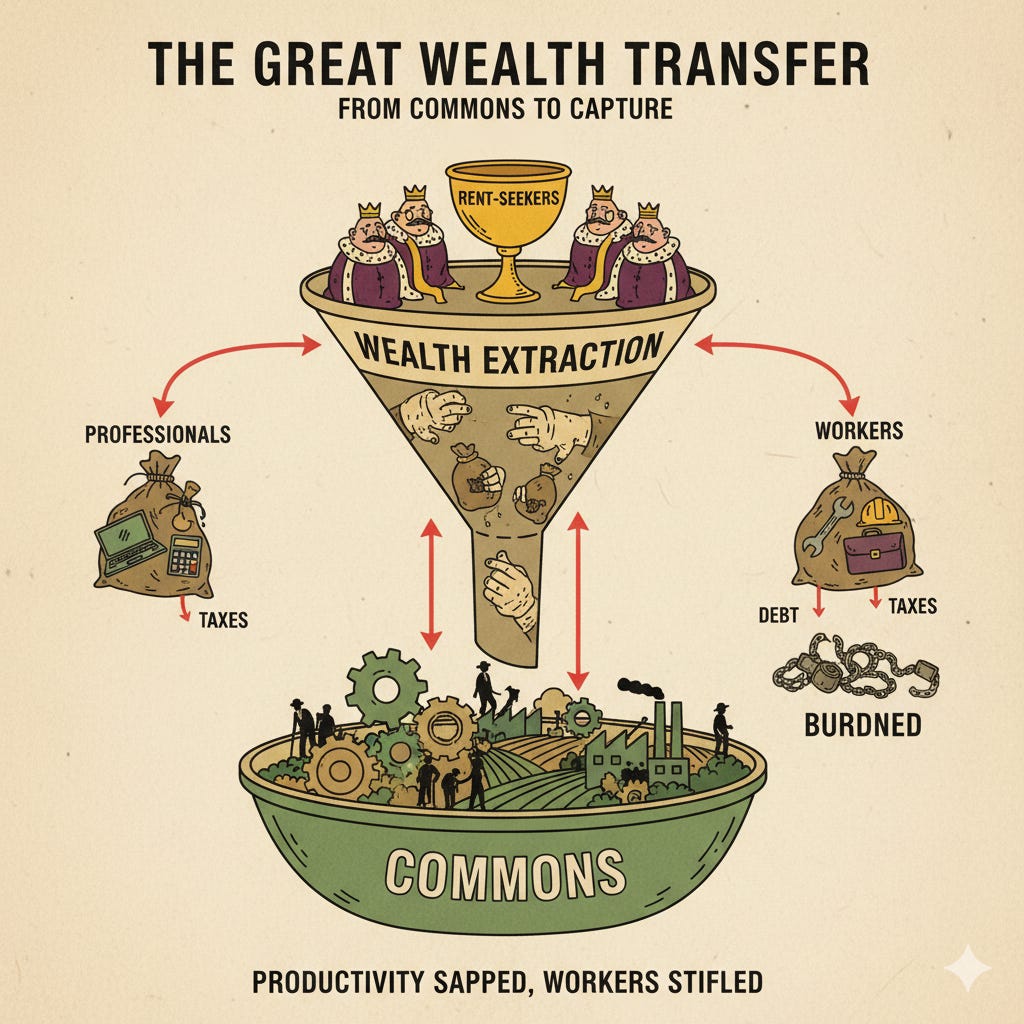

The current Cost of Living Crisis, manifested by chronic poverty, soaring housing costs, and systemic economic instability, is rooted not merely in temporary market failures or geopolitical events, but in a fundamental structural defect in the way modern industrial society is financed and governed.

The central cause is the systemic privatisation of Economic Rent (Rent) and the resulting Culture of Cheating (Free Riding), perpetuated by taxation policies and land monopoly.

1. The Systemic Root: Privatisation of Economic Rent

Economic Rent (Rent) as the nation’s surplus product or net income: the value that remains after remunerating labour (wages) and capital (profits or interest). It is the measured value of services provided by the “commons” of the natural universe and our social universe.

The crisis stems from the fact that this public value is appropriated by a privileged minority (rent-seekers or free riders) rather than being collected for communal use.

Institutionalised Cheating: The appropriation of Rent is an epic racket sanctioned by law. This institutionalised cheating, which began in earnest in Europe with the privatisation of land that was traditionally held in common (from the 16th century onwards), created a culture that systematically rewards value extraction rather than value creation.

The Structural Defect: The privatisation of these rents is the key driver of systemic violence and social friction, constituting the original structural defect in industrial society.

Taxation as Redistribution: Because Rent is not collected for the public purse, governments must fund public services by taxing earned incomes and consumption (known as deadweight taxes). This system covertly redistributes income from the poor to the rich. When the government funds infrastructure (such as highways) with taxpayer money, the subsequent increase in land value (Rent) is capitalised and captured by landowners as an unearned windfall gain. This means that the wealthy effectively receive back the money they pay in taxes, while low-income earners subsidise them.

2. The Mechanism of Instability: Land Speculation

The cyclical nature of the cost of living crisis, frequently leading to deep recessions and unemployment, is directly attributed to land speculation.

Boom-and-Bust Cycles: Land speculation is the prime mover of the boom-and-bust cycles in capitalist economies. The pattern involves a prosperity phase where normal economic growth raises incomes and land values; the optimism generated encourages landowners to overprice their land and its rent.

Reduced Profitability: Overpricing land and rents means a larger share of the economic pie goes to landowners, leaving less for true social investors. This dramatically lowers profits for entrepreneurs, deters fresh capital formation, and makes investment unattractive, leading to a system breakdown.

Credit Diversion: During periods of speculation mania, bidding for money to buy land pushes up the rate of interest, making it difficult to borrow money to finance the formation of new machines and jobs. Funds are preferentially channelled into the frenzied land market, crippling long-term investment in productive capacity.

The Inevitable Crash: Increasing speculation forces rents beyond the point of merely appropriating the economic surplus, demanding a slice of future output in the current period. This is inherently unstable and must lead to a general recession. Land remains overpriced even after the economy collapses because land has more “holdout power” than labour (which starves) and capital (which wastes).

3. The New Face of Poverty: The Professional Class Crisis

The crisis has metastasised beyond the traditional working class, now engulfing professionals once considered insulated from poverty. This shift marks a dangerous new phase in the “Culture of Cheating” where productivity is no longer a shield against destitution.

The Working Poor Professional: We are witnessing a historic decoupling of professional status and financial security. Junior doctors, teachers, and university academics—roles that historically guaranteed a middle-class existence—are now frequenting food banks. Surveys reveal that nearly half of junior doctors struggle with basic costs like rent and heating, often relying on credit or family support just to survive. University staff have been forced to strike not just for pay, but for the very ability to afford to live in the cities where they teach. This is a structural failure where even high-skilled labour cannot outpace the extractive power of Rent.

Housing as the Wealth Extractor: The primary mechanism of this impoverishment is the housing market. For essential workers in London, such as nursery assistants or care workers, rent can consume nearly 50% of their gross salary. This is not a failure of budgeting; it is a mathematical inevitability of a system where land values (Rent) capture almost all productivity gains. A medical student recently recounted hiding their homelessness from tutors, illustrating how the “safety net” has eroded to the point where even the future elite of our medical system cannot secure shelter.

The Gig Economy & Insecurity: This is compounded by the “financialisation” of the economy and the rise of the gig economy. Stable, long-term employment is widely replaced by precarious contracts that transfer all risk to the worker. This casualisation of labour serves the same master as land monopoly: it depresses the bargaining power of labour, allowing a greater share of wealth to be siphoned off as Rent by platform monopolies and corporate landlords. The “middle class” is shrinking not because they are working less, but because the Rent they must pay to live and work has devoured their surplus.

4. Political Enfeeblement: Servants of the Rent-Seekers

Why does the state fail to act? The answer lies in a political class that has been effectively captured by vested interests, rendering them incapable of implementing the obvious solution of Land Value Taxes.

The Landlord Parliament: The inability to pass meaningful housing reform is structurally guaranteed by the composition of Parliament itself. Recent analysis shows that approximately 1 in 10 MPs are landlords, including senior cabinet ministers. This creates a profound conflict of interest. When legislation like the Renters (Reform) Bill is introduced, it is systematically “watered down” by backbench rebellions and lobbying. Vital protections like the abolition of “no-fault” evictions are delayed or gutted because the legislators themselves profit from the current imbalance of power. They are effectively voting to protect their own passive income streams at the expense of their constituents’ security.

Regulatory Capture & The Revolving Door: Politics has become a revolving door for the property and finance sectors. Ministers frequently leave office to take lucrative roles in the industries they previously regulated—such as former Chancellor George Osborne joining BlackRock—creating a culture where political decisions are made with one eye on future corporate board seats. This “bureaucratic capital” ensures that policies favouring developers and landlords—such as subsidies that inflate house prices rather than funding social housing construction—are prioritised over the public good. The regulator has become the regulated.

Selling the Citizen’s Labour: Ultimately, the state has become an enforcement arm for rent-seekers. By refusing to tax land values and instead taxing labour heavily to fund infrastructure that boosts land values, the state effectively sells its citizens’ labour to monopolists. The struggle of the nurse or teacher paying 50% of their income in rent is not an accident; it is the direct result of a political choice to protect the unearned wealth of the asset-owning class at the expense of the productive economy. Politicians are not merely “enfeebled”; they are active participants in a system that transfers wealth from the many to the few.

5. Severe Social Consequences

The economic structure has resulted in profound and persistent social damage, which contributes to the crisis in welfare and public funding.

Poverty and Deprivation: The current system condemns the producer of wealth to poverty and pampers the non-producer in luxury. This means that a large proportion of the population is short-changed of the income it generates. Poverty has persisted spatially for over 100 years in certain London hot spots, despite the Welfare State.

Avoidable Deaths and Ill-Health: Economic stress links to profound psychological and physical damage. The complex interaction of forces traceable to tax distortions causes tens of thousands of people every year to suffer from premature death due to avoidable ill-health and homelessness. The late Dr George Miller attributed the annual avoidable deaths in England and Wales to taxation at approximately 50,000. In areas like Stockton-on-Tees and Blackpool, the average loss of life is up to 20 and 12 years, respectively, correlated with low land values.

Political Paralysis: The state is suffering from bureaucratic overload and is not able to discharge its fundamental functions because its financial viability is eroded by uncollected public value. Governments are often traumatised by the crisis, leading them to adopt simplistic ‘solutions’ that rely on sound budgeting for households rather than nations (e.g., monetarism), which fail to address the original problem.

Conclusion

The solution to this systemic crisis requires a radical reformation of public finance, specifically moving away from “mortal taxes” that penalise labour and onto a system of collecting the Annual Economic Rent of land. Without this, the “new face of poverty” will become the permanent face of the UK, as the productive class is slowly bled dry by the rent-seeking few.

Acknowledgements

This article stands on the shoulders of two intellectual giants whose decades of scholarship have preserved and advanced the Georgist tradition against overwhelming academic opposition.

My profound thanks to Mason Gaffney, whose meticulous historical research in The Corruption of Economics exposed the deliberate campaign to suppress Henry George's ideas. Professor Gaffney's forensic analysis of the neo-classical counter-revolution provides the essential foundation for understanding how economics lost its way. His lifetime of work demonstrates both the academic integrity and intellectual courage required to challenge economic orthodoxy.

My deep gratitude to Fred Harrison, whose pioneering analysis of the 18-year land cycle predicted both the 1990 and 2008 property crashes years in advance. Harrison's concept of the "predator culture" and his exposure of the "great tax clawback scam" have brought Georgist analysis into the 21st century, revealing how the private capture of economic rent continues to drive inequality and financial instability. His tireless work through the Land Research Trust has kept these vital ideas alive and relevant.

Both scholars have generously built upon Henry George's legacy while fearlessly exposing how vested interests corrupted economic science to serve private privilege over public good. Their work provides not just a critique of our broken system, but a practical blueprint for building a more stable, prosperous, and just economy.

This article is dedicated to all scholars and activists who continue the struggle for economic justice against what Gaffney rightly called "the stratagem against Henry George."

Comments

Post a Comment