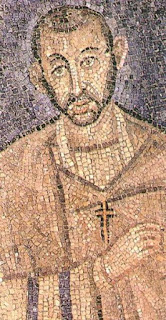

St Ambrose of Milan & the Causes of Poverty & Environmental Damage Today

A friend sent me some choice quotes from St. Ambrose of Milan (AD 339-397), who could have wrote these yesterday and not in the 4th century. A man who understood the natural world and that the fundamental causes of poverty and evil all stem from the private ownership and exploitation of the gifts of nature. This got me thinking, while I was just reviewing my pension today, the main reason I will live in penury in my old age is rent, not just rent of a house or the high cost of a mortgage but all the rents on all the things we have in life in a million complex ways that pervade our society. To get around this many old people cling on to property they do not need, and vehemently oppose the one fundamental solution to poverty and environment damage..... taxes on land. Thus we make the situation worse for all and the future, from our greed and fear today. Poverty and environmental destruction today both stem from the private wealth to be generated from forcing rent onto to the...