How Mandelson and Epstein Helped Put the UK Government on a Path to Crush the British People...

The “Epstein Files” are unearthing a travesty of filth and deep-seated corruption, yet the headlines often miss the structural rot at the core of these revelations. While the personal scandals are abhorrent, many fail to grasp the devastating role of Economic Rent in this betrayal and how it has systematically eroded our long-term prosperity.

In economic terms, “rent-seeking” occurs when the powerful gain wealth not by creating anything new, but by seizing control of existing assets—like land, infrastructure, or student debt—and charging the rest of society for access to them.

The leaked correspondence reveals exactly how this was engineered:

From Public Good to Private Yield: By identifying “saleable assets” Mandelson and Epstein weren’t just discussing a one-off sale; they were identifying new ways for the financial elite to extract “rent” from the British public in perpetuity.

The Debt Trap: When the government sells a state asset to a private entity, that entity then charges the public a premium for its use. This is why we see “Generation Rent” paying a massive portion of their income to landlords and interest to debt-collectors—money that is sucked out of the productive economy and into the pockets of those who own the “rent-generating” assets.

A Managed Decline: The corruption revealed in these files shows a government that stopped building national wealth and started facilitating the extraction of it. By coaching Epstein on how to threaten the state, Mandelson wasn’t just being a “best pal”—he was helping to dismantle the mechanisms of public prosperity to serve a parasitic financial class.

The “filth” in these files isn’t just moral; it is mathematical. It is the story of how Britain was turned into a “rentier economy,” where the many work to pay off the few, and our long-term growth is sacrificed at the altar of private greed.

Many of us have been left baffled by the UK government’s insistence on selling off state assets, alongside a policy framework that seems to drive individuals, businesses, and even charities into spiralling debt. At the time, I couldn’t fathom why even our state-owned nature reserves were being put on the market—but now, the true motivations have become clear.

The most recent analysis of the leaked correspondence reveals a sinister layer to the relationship between Peter Mandelson and Jeffrey Epstein. Beyond merely identifying “saleable assets,” the documents suggest that Mandelson provided a tactical roadmap for how the banking sector could exert leverage over the Sovereign state.

Weaponising Market Stability: The leaks show Mandelson coaching Epstein on the specific “pain points” where the banking industry could threaten the government. By highlighting the government’s terror of the “wall of debt,” the correspondence provided a blueprint for banks to essentially hold the state to ransom—threatening to withhold lending or destabilise the system unless their demands for deregulation and asset sales were met.

The “Impotence” Strategy: Shriti Vadera’s emails complained that the Treasury’s public posturing made the government look “impotent.” Mandelson appears to have exploited this perceived weakness, advising Epstein on how private interests could use this lack of confidence to force the government’s hand.

A “How-To” Guide for Financial Coercion: This was not a neutral exchange of information. It was a strategic briefing. By informing a high-finance intermediary like Epstein on how to effectively threaten the administration, Mandelson bypassed democratic accountability, giving private players the tools to dictate national policy from the shadows.

1. Summary

This report analyses recently leaked internal government correspondence from 2009 involving senior figures such as Peter Mandelson, Shriti Vadera, Jeremy Heywood, and external influence from Jeffrey Epstein. The documents reveal a critical juncture in the UK’s economic history where the government, facing a “wall of debt” and a potential electoral defeat, pivoted from traditional economic management to a strategy of aggressive asset liquidation.

The evidence suggests that the decision to sell off state assets—specifically student loan books, strategic infrastructure, and public land—was driven by a desire to avoid tax rises on corporations and high earners. Furthermore, the inclusion of Jeffrey Epstein in this sensitive loop raises profound concerns regarding the transparency of these sales and the prioritisation of global private capital over the long-term welfare of the British public. This pivot laid the structural foundations for the current cost-of-living crisis and the financial burden placed on students today.

2. The Economic Context: The “Wall of Debt”

The correspondence between Shriti Vadera (Cabinet Minister/Adviser) and Jeremy Heywood (Principal Private Secretary to the PM) in August 2009 exposes the government’s panic regarding a secondary economic collapse.

The Deleveraging Crisis: Vadera identified a “wall of banks having to refinance their own debt in 2010 and 2011,” involving trillions in securitisations. The government feared that without intervention, the economy would suffer an “inevitable and unstoppable” contraction as banks hoarded capital.

The Mortgage Freeze: The emails highlight that the securitisation market—the engine for mortgage lending—had collapsed. HBOS, holding a 20% market share, had “essentially stopped lending.”

The Policy Shift: The correspondence reveals a shift away from public welfare concerns towards propping up the banking system and asset prices to prevent a deleveraging spiral. This “credit easing” approach prioritised saving asset values (housing and corporate bonds) rather than ensuring affordability for the wider population.

3. The Butler Memo: The Pivot to Asset Sales

The most critical document regarding the long-term impact on the British public is the June 2009 memo from Nick Butler to Gordon Brown, which was subsequently forwarded by Peter Mandelson to Jeffrey Epstein.

Butler explicitly advised against raising taxes on “successful companies and individuals,” fearing it would drive business away. Instead, he proposed an “active financial policy” centred on “releasing value from the very substantial asset base which the Government holds.”

This strategy outlined the sale of £20 billion (later adjusted to £16 billion) of “non-strategic” public assets. The report identifies the specific targets of this sell-off, which directly correlate to modern hardships:

The Student Loan Book: The memo identifies the sale of the student loan portfolio to private investors. This decision marked the beginning of the financialisation of higher education, transforming students from beneficiaries of a public good into yield-generating assets for private equity.

Infrastructure and Transport: Assets such as the Dartford Crossing and the Channel Tunnel Rail Link (High Speed 1) were earmarked for sale or long-term concession. This transferred control of essential transport infrastructure to private entities, prioritising shareholder returns over stable utility costs for the public.

Public Land: The strategy necessitated the disposal of Ministry of Defence land, council farms, and British Waterways property. This mass sell-off of public land to private developers contributed to the current housing crisis, where land banking and high-margin developments have taken precedence over affordable social housing.

4. The Mandelson-Epstein Nexus

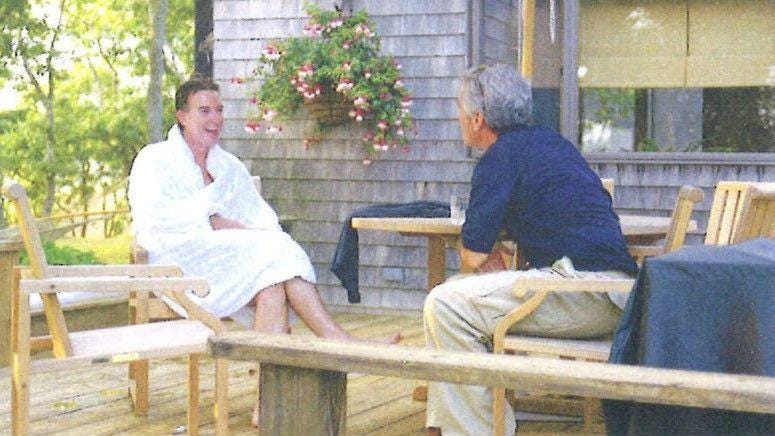

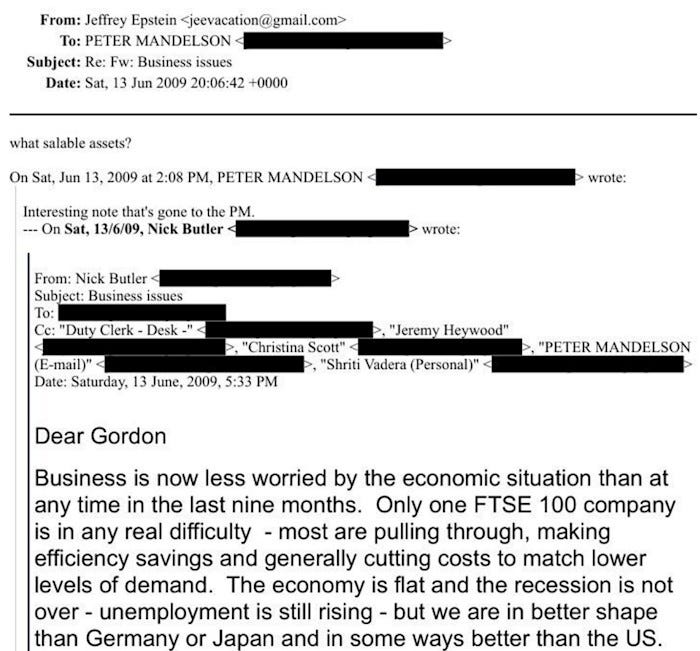

The leak reveals a disturbing lack of security and a potential conflict of interest regarding these national assets. On 13 June 2009, Peter Mandelson forwarded Butler’s sensitive economic advice—intended for the Prime Minister—directly to Jeffrey Epstein’s private email address.

“What Salable Assets?”: Epstein’s immediate response to the memo was to ask, “what salable assets?”

Implications: This exchange suggests that sensitive information regarding the privatisation of UK state property was being shared with ultra-high-net-worth foreign financiers before being made public. This arguably allowed for “front-running,” where private interests could position themselves to acquire undervalued state assets.

Governance Failure: That a non-national with no official security clearance was privy to the Prime Minister’s economic strategy indicates that the liquidation of UK assets was being treated as an opportunity for global elites rather than a rescue plan for the British taxpayer.

5. Conclusion: The Legacy of the Pivot

The documents demonstrate that the hardships currently suffered by the UK population—specifically the crushing burden of student debt and the cost of living crisis—are not accidental byproducts of the economy but the result of specific policy choices made in 2009.

Students: The decision to treat the student loan book as a “saleable asset” to pay down national debt fundamentally altered the university funding model, locking generations of students into a system designed to look attractive to private debt purchasers rather than to serve educational needs.

Cost of Living: By selling off infrastructure (tolls/rail) and public land, the government removed its ability to control costs in these sectors. The result is a privatised infrastructure network where price increases feed corporate profits rather than public reinvestment.

Inequality: The correspondence shows a government prioritising the protection of the asset-owning class (avoiding tax hikes, protecting corporate bond markets) while stripping the state of the wealth (land and infrastructure) that belonged to the public.

Concentration of Ownership: These sales contributed to the current UK land reality, where less than 1% of the population owns 50% of the land. As the public sector “crashed” its holdings, corporate and private gentry buyers absorbed the surplus

British Waterways (now Canal & River Trust): Parts of the land and property portfolio managed by British Waterways were reviewed for commercial disposal or transition.

Council Farms & Local Authority Land: This era saw a sharp decline in public sector land ownership, with an estimated 8% crash in public sector land holdings over the following years as local and national government-owned farms were sold off, locking out the only chance for young farmers to get a farm of their own.

In summary, the 2009 strategy was a “fire sale” of the family silver to delay a debt crisis, the price of which is being paid today by students and working-class families, while the benefits were seemingly offered on a platter to global financiers like Jeffrey Epstein.

Epstein File:

Leaked Emails & Reports:

This email chain from August 2009 contains a detailed discussion regarding the state of business lending in the UK following the 2008 financial crisis.

The primary correspondence is an extensive update from Shriti Vadera to John Pond, Jeremy Heywood, and Peter Mandelson, with a response from Jeremy Heywood.

Email 1: From Jeremy Heywood

From: “Jeremy Heywood” Date: Sun, 2 Aug 2009 20:00:07 +0100 To: Shriti Vadera (Personal); John Pond (E-mail) Subject: RE: BUSINESS LENDING

This is really helpful

Wd be good if you could take Charlie Bean and Paul Tucker through your analysis in detail – it is compelling in my view

How much more has been raised through the corporate bond market – or indeed rights issues – than you assumed at the time of the original gap analysis? The sooner we can get people to understand this point the better – as you imply

I still think HMT/BoE under-play the potential importance of non-bank players providing finance directly. Bank’s QE focus on buying gilts is fine – but they have not done enough credit easing in the Fed sense

AND we need the same analytical focus on the mortgage market as you have provided on the corporate market. Lack of securitisation market will be a real drag on that for years to come unless we find a way of getting the market to reopen

Email 2: From Shriti Vadera

From: Shriti Vadera (Personal) Sent: 02 August 2009 12:35 To: John Pond (E-mail) Cc: Jeremy Heywood; Peter Mandelson (E-mail) Subject: BUSINESS LENDING

I THOUGHT I SHOULD UPDATE YOU ON BUSINESS LENDING WITH MY THOUGHTS ON WHERE WE WERE IN LAST FEW MONTHS.

WHAT IS ACTUALLY HAPPENING?

WRT TO THE DEBATE ON IS IT DEMAND OR SUPPLY THERE IS NOT A REAL PROBLEM ON AVAILABILITY OF LENDING TO SME’S AND LARGE CORPORATES ANYMORE. HBOS CONTINUES TO BE A DRAG ON THE WHOLE MARKET WITH UPTO 20% SHARE AS THEY ESSENTIALLY STOPPED LENDING OCT-MARCH AND IT TAKES A WHILE TO GET TO FULL CAPACITY AGAIN BUT IT IS BEING WORKED ON. DEMAND HAS DROPPED VERY SERIOUSLY (ATLEAST 15% IF NOT MORE). THERE IS NO GETTING AWAY FROM THE FACT.

THERE IS A POTENTIAL PROBLEM OF INSUFFICIENT SUPPLY FOR THE DEMAND FROM MID SIZE COMPANIES (TURNOVER £10M-£500M) WHO ARE NOT BIG ENOUGH TO GO TO BOND MARKETS AND NOT SMALL ENOUGH FOR BANKS TO TAKE RISK. IRISH AND ICELANDIC BANKS WERE MORE ACTIVE IN THIS AREA. WE HAVE INVESTIGATED THIS ANALYTICALLY FOR THE LAST 8-10 WEEKS AND (IGNORING HMT OBJECTIONS) HAVE NOW PROVIDED ALL OF THE BANKS WITH THE NAMES AND ADDRESSES OF ABOUT 1700 GOOD CREDIT RISK COMPANIES WHO EMPLOY ABOUT 800,000 PEOPLE AND COULD NEED ABOUT £5BN. MORE THAN HALF ARE GROWTH COMPANIES. THIS IS POTENTIAL NOT REAL DEMAND AND THE LIST WILL HAVE SOME ERRORS. I DO NOT KNOW YET IF THE NUMBERS WILL STACK UP SO PLEASE DO NOT USE THEM IN PUBLIC. THE COMPANIES MAY NOT BE CONFIDENT ENOUGH TO BORROW. ALL OF THE BANKS WERE PLEASED WITH THIS WORK AND HAVE AGREED TO CONFIRM THE FINDINGS AND CONTACT THE COMPANIES TO OFFER LOANS. WE WILL FOLLOW UP. IF THERE IS GOOD EVIDENCE THAT IT WORKED WE CAN PUBLICISE THIS IN OCTOBER

THERE IS POTENTIALLY A PROBLEM WITH LONGER MATURITIES (5 YEARS PLUS BUT FOR SOME MAYBE 3 YEARS PLUS). WE ARE INVESTIGATING TO GET AN EVIDENCE BASED APPROACH. ONE REASON MAYBE BANKS THEMSELVES CANNOT GET LONG TERM FUNDS. AFTER 6 MONTHS OF ASKING MYNERS HAS AGREED TO LOOK INTO THAT PROBLEM

THERE IS POTENTIALLY A PROBLEM - BUT WE HAVE NO EVIDENCE - ABOUT TOO MUCH RISK AVERSION AND MARGINS GOING UP TOO MUCH. CURRENTLY BECAUSE INTEREST RATES ARE DOWN PRICES DO NOT LOOK TO BE HIGHER OVERALL TO BORROWERS THAN THEY WERE 2 YEARS AGO. OVERALL COST OF FUNDS IS NOT NECESSARILY A REASON FOR DEMAND FALLING (CONTRARY TO STATEMENTS BY AD). MARGINS SHOULD IN ANY CASE GO UP BECAUSE THEY WERE TOO LOW AND RISK HAS GONE UP. WE ARE INVESTIGATING HOW MUCH BY AND IF IT IS JUSTIFIED. HBOS MARGINS ARE GOING UP DRAMATICALLY BECAUSE THEY WERE SEVERELY UNDERPRICING IN THE PAST BECAUSE OF THEIR POLICY OF FUNDING SHORT AND LENDING LONG. IT IS CREATING THE BAD OVERALL IMPRESSION IN THE MARKET BUT THERE IS NO REAL ANSWER TO THIS AS THEY HAVE TO CORRECT

THE THREE PIECES OF WORK ON RISK AVERSION, PRICING AND MATURITIES IS BEING DONE JOINTLY WITH HMT. THE MID SIZE WORK WAS DONE BY ME AND BIS. HMT MAY SLOW US DOWN ON THE OTHERS BUT I WILL LET YOU KNOW IF I NEED HELP

WE NEED TO MANAGE EXPECTATIONS ON LENDING AGREEMENTS WHICH WILL NOT BE MET. THIS IS NOT BECAUSE WE CAN’T MAKE THE BANKS DO THE RIGHT THING - WE CAN - BUT BECAUSE THE LARGE COMPANY NUMBERS HAS PROVEN TO BE NOT NEEDED AS BOND MARKETS ARE VERY STRONG COMPARED TO OUR PROJECTIONS IN JANUARY AND FOREIGN BANKS HAVE NOT WITHDRAWN AS MUCH AS EXPECTED IN THIS SEGMENT. THIS IS GOOD NEWS NOT BAD NEWS (EXCEPT OF COURSE THE FALL IN DEMAND PROBLEM)

THERE WILL BE SOME INTRACTABLE ISSUES. FOR EXAMPLE 1. MANY COMPANIES ARE OVERLEVERAGED (EG 5 OR 6 TIMES THEIR PROFIT) BECAUSE OF PAST LAX CONDITIONS. WHEN THEY COME TO REFINANCE THEY WILL NOT BE ABLE TO REFINANCE THE SAME AMOUNT (EG CONDITIONS NOW 2- 3 TIMES THEIR PROFIT) AND SO WILL HAVE TO FIND EQUITY SOMEHOW OR SERIOUSLY RESTRUCTURE AND IN SOME CASES GO UNDER. 2. PRIVATE EQUITY DEALS WHICH DEPENDED ON LEVERAGE TO MAKE MONEY HAS BEEN UNABLE TO ACCESS DEBT SO THESE DEALS HAVE DRIED UP UNLESS THEY ALREADY HAVE DEBT. 3. COMMERCIAL PROPERTY WHICH WAS A LARGE PART OF THE RECENT INCREASE IN THE RUN UP TO 2007 IS FOR OBVIOUS REASONS A PROBLEM ALTHOUGH THE BANKS APPEAR TO BE BEHAVING SENSIBLY AND NOT FORECLOSING AS ITS NOT IN THEIR INTERESTS. THESE POCKETS OF PROBLEMS REMAIN.

OVERALL I REMAIN CONCERNED THAT THE ECONOMY WILL DELEVERAGE. IT HAS TO BY DEFINITION AS IT WAS OVERLEVERAGED. WE ALSO FACE A WALL OF BANKS HAVING TO REFINANCE THEIR OWN DEBT IN 2010 AND 2011 WITH THEIR SECURITISATIONS COMING DUE, GOVERNMENT GUARANTEED DEBT WHICH ENDS THEN, AND OTHER DEBT. TRILLIONS. THE SECURITISATION MARKET HAS NOT RESTARTED AND THERE IS NO OBVIOUS SOURCE OF ALTERNATIVES TO GOVERNMENT GUARANTEED DEBT AND SECURITISATION. IF THERE ONE IS NOT FOUND THE DELEVERAGING OF THE BANKS IS INEVITABLE AND UNSTOPPABLE. WE HAVE BEEN SPEAKING TO HMT ABOUT THIS FOR MONTHS - THEY HAVE JUST STARTED TO LOOK AT IT

OUR APPROACH NEEDS TO CHANGE

MERVYN KING IS OFF THE PAGE. HE IS WINDING PEOPLE UP ABOUT BANKS NOT LENDING WITH NO EVIDENCE AND HAS BEEN DESTABILISING THE SYSTEM BY TALKING ABOUT BANKS NEEDING MORE CAPITAL.

IN MEANTIME HMT ARE UNAWARE OF THE ISSUES AT A GRANULAR LEVEL - EXHORTING BANKS TO LEND MORE AT A HIGH LEVEL WILL NOT WORK UNLESS WE CAN DO IT ISSUE BY ISSUE WITH EVIDENCE. AD STILL TALKED ABOUT SME LENDING NOT BEING AVAILABLE AND HAS NO REAL UNDERSTANDING WHAT IS HAPPENING AT THE LEVEL SET OUT IN THIS EMAIL.

THEY ARE MISINTERPRETING YOUR INSTRUCTIONS TO DO MORE ABOUT LENDING BY ASKING PAUL AND ME TO SEE CEO’S AND ASK THEM TO LEND MORE. THIS WAS A POINTLESS EXERCISE WHICH WILL NOT WORK AND HAS EXPOSED A DEGREE OF IGNORANCE I WAS EMBARRASSED TO BE ASSOCIATED WITH.

AND THEY ARE WHIPPING UP THE PRESS ON THIS WHICH ONLY MAKES US LOOK IMPOTENT AND DESTROYS BUSINESS CONFIDENCE WHEN IN FACT WE HAVE BEEN SUCCESSFUL IN PART IN INCREASING AVAILABILITY OF LENDING. BUSINESSES NEED TO FEEL CONFIDENT THEY WONT BE TURNED DOWN.

AD INSTRUCTED PAUL TO THREATEN BANKS WITH OFT INVESTIGATION. THIS IS COUNTERPRODUCTIVE, NOT JUST BECAUSE IT DESTABILISES THE LLOYDS MERGER WHICH THE OFT ARE DYING TO UNPICK, BUT BECAUSE WE ARE ACTUALLY ASKING BANKS TO INCREASE THEIR MARKET SHARE BY LENDING MORE TO MAKE UP FOR SMALL AND FOREIGN BANKS. AND THEN WE THREATEN THEM WITH OFT WHICH WILL INVESTIGATE THEIR MARKET SHARE. IT WAS BEYOND SILLY.

I THINK WE NEED TO CHANGE OUR APPROACH TO

CHANGE OUR PUBLIC POSITION TO BANKS ARE PREPARED TO LEND. IT’S WORKING. WE HAVE FOUND SMALL POCKETS OF UNMET DEMAND AND BANKS ARE DEALING WITH IT. WE ARE INVESTIGATED PROBLEMS ON MATURITY AND MFEES ETC. GOOD BUSINESSES SHOULD APPROACH BANKS WITH CONFIDENCE. IF THEY ARE TURNED DOWN, GO TO THESE FOLLOWING NUMBERS FOR HELP (HESTER HAS AGREED TO WRITE TO EVERY MP AND GET A HELPLINE NUMBER FOR BUSINESSES TO CALL) OR COME TO US. ((YOU SHOULD BE AWARE ALMOST WITHOUT EXCEPTION EVERY CASE INVESTIGATED BY BIS, THE COMPANY HAD EITHER ASKED HBOS IN OCT -MARCH OR WAS NOT CREDITWORTHY)). SENIOR POLITICIANS SHOULD BE AWARE OF THE INDIVIDUAL ISSUES AND NOT MAKE GENERAL STATEMENTS THAT MAKE IT LOOK UNSUCCESSFUL AND US IMPOTENT.

WE SHOULD STOP USING THE OFT INVESTIGATION THREAT. YOU WOULD NEED TO ASK AD TO DO THAT

WE SHOULD TALK TO THE BANKS ABOUT THE INDIVIDUAL ISSUES - MID-SIZE, PROJECT FINANCE, OVERLEVERGAED COMPANIES, RISK AVERSION, MARGINS - AND ON A BILATERAL BASIS AS NO BANK WILL SAY ANYTHING SERIOUS IN FRONT OF ANOTHER. IT SHOULD BE DONE ON EVIDENCE ON EACH ISSUE WHICH WE ARE WORKING ON AND NOT ANECDOTES. I HAVE AGREED WITH THE BANKS THAT IS WHAT I AM GOING TO DO. NO IDEA WHAT HMT WILL DO.

SOMEONE NEEDS TO HAVE A SERIOUS CHAT WITH MERVYN KING

HMT NEEDS TO GET SERIOUS ABOUT THE PROBLEMS OF FUNDING MARKETS FOR BANKS

WE NEED TO CONSIDER THE PROVISION OF EQUITY NOT JUST DEBT IF WE WANT COMPANIES TO SURVIVE. I HAVE ASKED FOR SOME WORK

Email 3

This document consists of an email thread from June 2009 involving Nick Butler, Peter Mandelson, and Jeffrey Epstein, regarding economic advice sent to then-Prime Minister Gordon Brown.

Email Header Information

From: [Redacted]

To: “Jeffrey Epstein” jeevacation@gmail.com

Subject: Re: Fw: Business issues

Date: Sat, 13 Jun 2009 20:13:37 +0000

Message: Land, property I guess Sent from my BlackBerry® wireless device

From: Jeffrey Epstein Date: Sat, 13 Jun 2009 16:06:42 -0400 To: PETER MANDELSON petermandelson@btinternet.com Subject: Re: Fw: Business issues

Message: what salable assets?

On Sat, Jun 13, 2009 at 2:08 PM, PETER MANDELSON wrote: Interesting note that’s gone to the PM.

The Original Memo

From: Nick Butler Subject: Business issues To: [Redacted] Cc: “Duty Clerk - Desk -”, “Jeremy Heywood”, “Christina Scott”, “PETER MANDELSON”, “Shriti Vadera (Personal)” Date: Saturday, 13 June, 2009, 5:33 PM

Dear Gordon

Business is now less worried by the economic situation than at any time in the last nine months. Only one FTSE 100 company is in any real difficulty - most are pulling through, making efficiency savings and generally cutting costs to match lower levels of demand. The economy is flat and the recession is not over - unemployment is still rising - but we are in better shape than Germany or Japan and in some ways better than the US. The data on inward investment is excellent, as are the revised forecasts on unemployment which now suggest a peak below 3 million.

Business support for the Government has been destabilised by the events of the last four weeks but there remains no fundamental divergence of view about economic policy or the Government’s management of the banking crisis.

Business is probably now marginally anticipating a Tory victory - just on the basis of the Euro results and the polls - but there is no evident enthusiasm, and very noticeably no stream of endorsements of Cameron by business leaders.

In going round I am still getting a good reaction.

There are three key issues which deserve attention before the summer.

First we need to encourage and bring forward private sector investment. There is a clear consensus among commentators from Martin Wolf to Paul Krugman that the economic upturn will come not as a result of personal consumption, or public spending. Nor, given the downturn in global trade will it come from exports. Private sector investment is absolutely critical. I think Shriti would endorse this view. Most forecasts show an upturn in private investment coming from 2010 onwards. If we could bring it forward by 6/9 months it would advance the upturn and change the outlook going into 2010. I have suggested to Peter that the Business Department should examine the barriers and disincentives to investment and come up with a plan to encourage investment across the economy. Although some companies have difficult getting credit, many more are hoarding capital - there have been a number of major issues of corporate bonds. Many companies also have growth plans on hold. The challenge is to get that money moving.

Apart from expectations about the economy, which are now moving in a helpful direction the only major device available to Government is a further extension of the capital allowances announced in the Budget. We should consider raising the capital allowance on new investment to 75 per cent ( or even more ) for the remainder of this tax year.

It would be even better of course to do on a pan European basis ( because we need a revival of the European economy to sustain exports ) but it would probably take too long to get agreement so we should take the lead.

Secondly we need to develop an active financial policy to match the active industrial approach.

The thing which worries business most is the threat of further tax rises - on successful companies and on individuals.

Many business leaders have accepted the IFS view, echoed by the FT, that the current Treasury projections of the financial outlook are not sustainable. We have not yet successfully countered that argument.

I think the answer lies in releasing value from the very substantial asset base which the Government holds. A number of business leaders who understand financial engineering have asked in different ways why we are borrowing so much and tolerating such high debt charges when we have saleable assets in hand which are not strategic - i.e. there is no good political or economic reason why they are in the public sector.

I know Jeremy has done some work on this.

The point which the Tories appear to have missed in focusing the argument on cuts v spending is that asset sales of even £ 20 bn would relieve the debt burden, reduce borrowing costs, and provide some funds for new investment.

Such an approach would permit the development of selective incentives for investment - which is just what the economy needs. It would also enable us to go into the election with a pledge not to make any further increase in corporate or top rate income taxes in the next parliament. This is important because there are still some companies - mostly in the financial area but also highly mobile companies such as GSK which are investigating the possibility and costs of moving out of the UK. Tax for them is the critical issue and as well as dealing with the specific issues such as taxation of patents a firm overall pledge on taxes would ease the pressure to move.

I believe it would be worth asking Liam, who has experience in this area to come up with a asset sales plan. I am sure the banks would have a number of creative ideas.

The third is to engage with business - to listen, to invite views and to demonstrate our alignment with their objectives. Most importantly they need to understand our view of the causes of the problems and our response - broadly as you set it out at the CBI in May. They also need a channel for expressing their concerns. The communications process - nationally and regional - should explicitly include business as a target audience and there is a good case for finding another key business audience to which you can talk before the summer.

Best wishes

Nick

Comments

Post a Comment