The Offset Trap: Why UK Nature is Losing to Private Equity

How Speculative Offset Markets and Inflated Land Values are Undermining UK Nature Conservation - Bankrupting Britain & Our Environment

Peter Smith

1. Summary

A growing body of evidence suggests that the current model of “Green Finance”—specifically Carbon Offsetting and Biodiversity Net Gain (BNG)—is actively harming the UK’s ecological recovery. Rather than funding nature, these markets have commodified it, creating a “Green Rush” that has inflated land prices beyond the reach of conservation charities. Furthermore, the pressure to deliver quantified “units” of carbon or biodiversity has led to ecologically naive management practices, such as planting trees on deep peat and other carbon-rich soils, which releases more carbon than it saves. The stark reality is that high land values, poor standards, and “carbon tunnel vision” are facilitating environmental degradation.

2. The Economic Barrier: Pricing Out Real Conservation

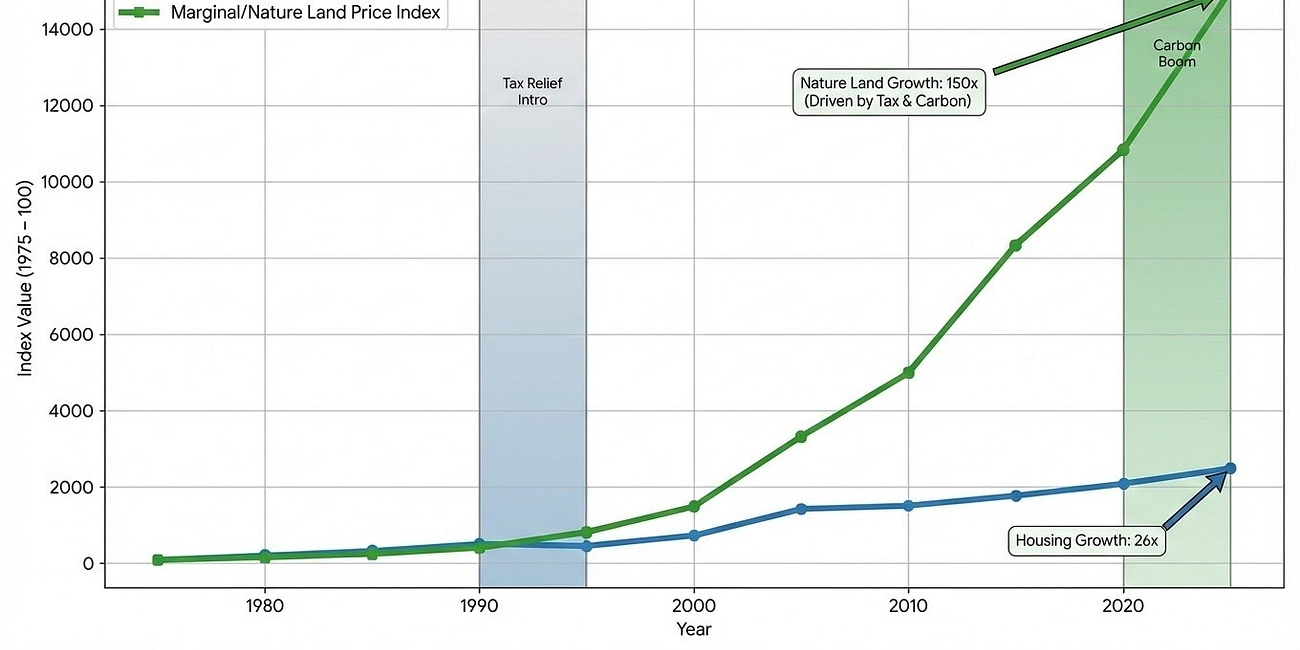

The primary damage caused by the offsetting market is economic. By assigning a speculative financial value to “potential carbon,” corporate buyers have severed the link between land value and its agricultural or ecological reality.

The “Green Premium” vs. Charities: Conservation bodies like the RSPB, The Wildlife Trusts, and the National Trust operate on fixed budgets (donations/grants). They effectively cannot compete with multinational corporations (e.g., airlines, energy firms) who view land purchase as a marketing expense or a balance sheet asset.

The Consequence: The State of Nature report and recent RSPB analyses highlight that “Green Finance” has not mobilised new money for nature; it has simply transferred land ownership to private equity firms.

Source: A joint report by the RSPB, National Trust, and Wildlife Trusts found that private finance is largely flowing into “high yield” carbon monocultures rather than complex, low-profit habitat restoration.

Blocking Rewilding: Genuine rewilding (process-led restoration) is messy and unpredictable. It does not produce neat, saleable “units” of carbon in Year 1. Therefore, investment flows to “planting” (which can be counted) rather than “regenerating” (which takes time), effectively killing the business case for wilder landscapes.

3. The “Carbon Tunnel Vision”: Ecological Failure

The obsession with “Net Zero” has led to a reductionist approach where complex ecosystems are managed solely for their ability to sequester carbon, often with disastrous results.

A. The “Right Tree, Wrong Place” Disaster

The most egregious failure is the planting of trees on carbon-rich soils (peatlands and organo-mineral soils).

The Science: Peatlands store vastly more carbon per hectare than woodlands. Planting trees on peat requires drainage and “mounding” (digging up soil to create dry planting spots). This dries out the peat, causing it to oxidise and release massive amounts of CO₂.

The Evidence: Research by the Natural Capital Committee and the University of Exeter (Prof. Ian Bateman) confirms that planting trees on peat is a “serious mistake” that creates a net source of emissions.

The Result: We are destroying permanent carbon stores (peat and other carbon-rich soils) to create temporary, vulnerable carbon stores (trees).

B. Case Study: BrewDog’s “Lost Forest”

The craft beer giant BrewDog purchased the Kinrara Estate in the Scottish Highlands for roughly £8.8m to create a “Lost Forest” and become a carbon-negative business. The project has become a textbook example of offsetting failure.

High Mortality: In 2024/25, it was revealed that over 50% of the planted pine saplings had died due to a combination of extreme weather and poor ground conditions.

Ecological Naivety: Critics, including Parkswatch Scotland, documented that the planting involved aggressive ground preparation (digger mounding) on peat-rich soils. This released soil carbon and damaged the existing ecosystem.

The Outcome: The project failed to deliver the promised “sequestered carbon” but succeeded in disturbing the landscape. In late 2025, BrewDog sold the estate, effectively abandoning the long-term stewardship required for a forest to actually mature.

Source: The Guardian, Parkswatch Scotland, The Scottish Farmer.

4. “Standardisation” of Nature: The BNG Failure

Biodiversity Net Gain (BNG) was intended to stop housing developers from cementing over nature. In practice, it has created a “trading” system that allows destruction in exchange for “credits” of dubious quality.

The “Phantom” Credits: Developers can destroy a mature hedgerow (high biodiversity) and pay for a “new” hedgerow elsewhere. However, a new twig in a plastic tube does not support the same insects as a 50-year-old hawthorn.

Lack of Enforcement: A 2025 report by the Local Government Association (LGA) noted that 90% of councils lack the ecological staff to monitor these sites. There is no guarantee that the “offset” habitat will actually exist in 5 years.

The Monoculture Problem: To maximise “units” per acre, landowners are incentivised to plant simple, easy-to-measure habitats (like species-poor grassland or commercial timber) rather than complex scrub or wetlands, which are harder to quantify in a spreadsheet.

5. The Demand Drivers: Airlines & Housing

The market for these “junk credits” is driven by industries that need to justify continued high-carbon activities.

Airlines (The Moral Hazard): By purchasing cheap offsets (often based on “avoided deforestation” or cheap tree planting), airlines can claim “Carbon Neutral Flights.” This delays the investment in genuine decarbonisation (e.g., Sustainable Aviation Fuel).

Impact: This demand creates the financial incentive for land agents to sell Scottish hillsides as “Offset Opportunities,” inflating the price for everyone else.

House Building: The pressure to build 300,000 homes a year requires land. BNG credits allow developers to build on greenfield sites by promising to “improve” land elsewhere. This “offsetting” acts as a permission slip for destruction, creating a cycle where nature is shunted into ever-smaller, disconnected corners of the country.

6. Conclusion: A System Designed for Finance, Not Nature

The current UK land market is failing nature because it values outputs (carbon credits/timber) over outcomes (ecosystem health).

Price: It has made land too expensive for charities to buy and protect.

Practice: It rewards destructive interventions (digging up carbon-rich soils to plant trees).

Permanence: It relies on temporary corporate ownership (like BrewDog) rather than perpetual public, charity or community stewardship.

Recommendation: True conservation requires a move away from “Offsetting” (which allows pollution to continue) towards “Contribution” (where companies pay for nature restoration without claiming the carbon against their own footprint). Until the link between “polluting” and “buying land” is broken, the market will continue to prioritise profit over ecology.

7. The Policy Solution: A Structural Reset

The current system is failing because it attempts to “patch” market failures with complex subsidies and offset markets. A more effective solution lies in fundamental tax reform: shifting the burden away from productive labour and investment, and onto land values and carbon pollution at source.

This “Green Tax Shift” would dismantle the artificial land values described in this report and drive genuine ecological restoration.

A. The Power of Land Value Tax (LVT)

Currently, the UK tax system (Business Rates and Council Tax) penalises property improvement. If you build a house or improve a factory, your taxes go up. Conversely, if you hold empty land as a speculative asset, you pay little to nothing (and often claim Agricultural Property Relief). This incentivises land hoarding and inefficiency.

How LVT Solves the Conservation Crisis:

Ending Speculation: A Land Value Tax is levied on the unimproved value of the site. This instantly removes the “Safe Haven” status of land. Investors can no longer buy Scottish hillsides just to park cash tax-free; they would face an annual holding cost. This would cause the speculative bubble to burst, returning land prices to their “utility value” (what the land can actually produce).

Shifting the “Margin of Production”:

Prime Land: On fertile soil or near cities, LVT encourages maximum efficiency (building homes or intensive food production) because the tax bill must be paid. This reduces the pressure to sprawl into the countryside.

Marginal Land: On the poor-quality uplands (where nature reserves are usually found), the rental value—and therefore the tax—would be negligible. Without the artificial incentives of CAP subsidies or tax reliefs to “farm” this land unprofitably, the most economic use becomes low-input rewilding.

Result: The “margin of production” shifts naturally. Marginal land is released from forced agriculture (e.g., sheep on steep hills) and allowed to regenerate, creating vast, complex sinks for carbon and biodiversity without the need for expensive “offset” payments.

B. Carbon Tax “At Source” (The End of Offsetting)

The current “Offset Market” is a downstream fix—trying to mop up carbon after it has been spilt. A true solution taxes the spill before it happens.

The Mechanism: A uniform Carbon Tax applied at the point of entry (the mine, the oil well, the gas port).

Killing the “Greenwash”: If airlines and housebuilders pay the true cost of their carbon upfront (e.g., £100/tonne), the financial incentive to buy cheap, low-quality “offsets” evaporates. The “carbon price” is no longer set by a dubious tree-planting scheme in the Highlands, but by the Treasury.

Driving Innovation: A high, inescapable carbon price forces businesses to innovate to reduce emissions rather than paying a landowner to plant trees on deep, complex carbon-rich soils. The efficiency is driven by technology, not land grabbing.

C. The “Double Dividend”: Taxing Pollution, Not Work

This proposal is not about increasing the overall tax burden; it is about shifting it. The revenue raised from LVT and Carbon Taxes should be used to fund a direct reduction in Income Tax and Taxes on real investment (not speculation).

Stop Taxing Hard Work: Currently, the UK heavily taxes labour (people working hard) and real enterprise (profits from productive business). This discourages employment and investment.

Start Taxing Scarcity: By taxing land (a fixed resource) and carbon (a public bad), we encourage the efficient use of both.

The Economic Result: “Real” investment flows into R&D, staff training, and sustainable infrastructure, rather than being sunk into passive land speculation.

8. Conclusion: From “fake” to “Real” Rewilding

By removing the tax distortions that prop up high land prices, the market for nature would normalise. Charities would no longer need to raise millions to buy small parcels of land; instead, the economic reality would force marginal land to rewild itself.

We do not need to commodify nature into “units” to be traded by hedge funds. We simply need to tax the things we want less of (pollution and land hoarding) and untax the things we want more of (work and genuine investment).

9. The Great Hijack: Regulatory Capture and the Financialisation of Nature

The transformation of the UK countryside into a speculative asset class was not an accidental market failure; it was a policy choice. Increasingly, public policy has been effectively hijacked by the financial services industry, allowing hedge funds and bankers to extract enormous paper profits from the environment while the natural world continues to decline.

This “financialisation of nature” represents a profound failure of governance, where the custodians of the state—politicians and civil servants—have become architects of a system that impoverishes both the public and the land.

A. The Mechanism of the “Scam”

Rather than enforcing simple, effective environmental protections (e.g., “polluter pays” taxes or strict legal bans on habitat destruction), the government has opted for complex “market-based mechanisms” such as Biodiversity Net Gain and Carbon Credits.

Why? Because simple laws do not generate fees for the City of London. Complex trading schemes, however, require brokers, verifiers, consultants, and asset managers.

The Result: We have created a multi-billion pound industry of “middlemen” who trade virtual units of nature. The majority of the money spent on “green finance” does not go to planting trees or restoring wetlands; it goes to legal fees, consultancy reports, and the profit margins of land-holding investment funds.

B. The Culpability of the State

This system was built through the active complicity of the political and administrative class:

Politicians (The “Free Lunch” Lie): Successive governments have embraced private “Green Finance” because it allowed them to abdicate responsibility. By promising that “private capital” would fund nature recovery, politicians could avoid the difficult decision of raising public funds or taxing polluters directly. They effectively outsourced nature conservation to the very markets that destroyed it, selling the public a lie that the City could turn a profit and save the planet simultaneously.

Civil Servants (The Bureaucratic Wall): Departments such as DEFRA have designed systems of mind-bending complexity (e.g., the Statutory Biodiversity Metric). This complexity is a feature, not a bug. It ensures that ordinary farmers and local communities are excluded from the market, as they cannot afford the specialist consultants required to navigate the rules. This clears the field for large institutional investors—hedge funds and insurance giants—who have the resources to game the system and capture the subsidies.

C. The Transfer of Wealth

Ultimately, this represents a massive transfer of wealth from the public purse and the working population to the asset-rich elite.

The Public Pays Twice: First, the public pays the subsidies (via taxation) that de-risk these schemes for investors. Second, the public pays the inflated costs of housing and food, driven up by land speculation.

The Paper Profit: While a hedge fund may book a 20% return on a “Natural Capital Portfolio” based on rising land values and credit prices, the physical reality is often a degrading monoculture of sitka spruce or a “restored” meadow that exists only on a spreadsheet.

By prioritising the creation of tradable financial assets over the physical restoration of ecosystems, the UK government has overseen a giant confidence trick: a system where bankers get rich, the public gets poorer, and nature gets a column in a ledger.

Sources & Further Reading on Green Tax Shifts:

The Mirrlees Review (IFS): Comprehensive analysis on the efficiency of Land Value Taxes over property taxes.

Vivid Economics: Reports on “Carbon Pricing at Source” vs downstream trading schemes.

Campaign for Land Value Tax (UK): Analysis of how LVT prevents urban sprawl and rural land banking.

Professor Dieter Helm (University of Oxford): Net Zero (2020) – Argues that “Carbon Taxes” are the only efficient route, dismissing offsetting as “greenwashing.”

Make sure you read the previous report on 50-year Land Value Trends, analysing the effects of economic policy on Land Value:

Green Deserts & Paper Profits: The True Cost of UK Land Wealth

A Fifty-Year History of UK Land Values: From Productive Asset to Financial Monopoly

Comments

Post a Comment